Zero-down USDA Protected Fund are the best outlying creativity financial program inside the Iowa. This type of financing are for sale to a person with low so you’re able to modest money to shop for property during the acknowledged outlying areas without off commission. The fresh USDA Secured Loan System is also the most popular no-down-payment mortgage within the Iowa having low-veterans today, and can be used for a bigger list of candidate incomes than just USDA Lead Financing.

Exactly what are Iowa USDA Loans?

New USDA mortgage program was created because of the United states Company out-of Agriculture Outlying Development, labeled as USDA RD. USDA Guaranteed Finance (also known as USDA Area 502 Protected Funds) is a mortgage system getting reasonable and you can average income financial individuals. Iowa USDA finance promote lower-rates, bodies covered home loan options that fit many different property needs. The most famous mortgages provided compliment of USDA are known as Guaranteed money. USDA Secured Loans are 100% investment mortgages, so you may use these to pick a house with zero down payment.

Iowa USDA Financing Standards

USDA financing standards mostly concentrate on the financial candidate and you may the house or property. To begin with, our home should be situated in a medication outlying section so you can meet the requirements qualified to receive USDA financial support. Next out of, your house buyer need certainly to fulfill the money standards established by USDA. These types of money constraints was established by way of a combination of loans-to-money ratios and you will money ceilings you to definitely equivalent 115% of the town average income (AMI) towards form of city. Statewide, Iowa carries a median household earnings out of $sixty,523, but that can range between state so you’re able to state. At some point, the newest applicant also needs to fulfill the lender conditions getting mortgage approval including:

- Credit Requirements

- Income Standards

- Records Standards

Iowa USDA Mortgage Restrictions

USDA doesn’t place certain restrict mortgage numbers to possess secured mortgage loans. Rather, local restrictions decided from the a mixture of the area USDA limit money limitation therefore the borrower’s obligations-to-income ratios. This method ensures that protected Iowa USDA loan constraints was liquid and established several affairs. The limits listed here are centered on approximate calculations. Real guaranteed loan limitations may differ.

Extra USDA Limits

- Iowa USDA Protected Mortgage Money Limitations

- Iowa USDA Head Loan Limits

- Iowa USDA Lead Loan Earnings Restrictions

- All the USDA Financing Limitations

- USDA Mortgage Criteria

- Restrict Amount borrowed: There’s absolutely no put restriction amount borrowed getting USDA rural lenders when you look at the IA. As an alternative, your debt-to-earnings rates influence how much domestic their can afford ( ratios). Simultaneously, your complete family monthly earnings have to be inside USDA greeting limit earnings restrictions to suit your town. Limitation USDA Protected Mortgage money restrictions for everyone section are bought at right here.

What kinds of financing really does USDA bring inside the Iowa?

One or two USDA mortgage options are at this time available in Iowa to possess solitary nearest and dearest households. These software is supported by the fresh new You.S. Agency regarding Farming as a result of its Rural Innovation Homes Funds:

Exactly what circumstances know if I am eligible for a beneficial USDA Loan inside the Iowa?

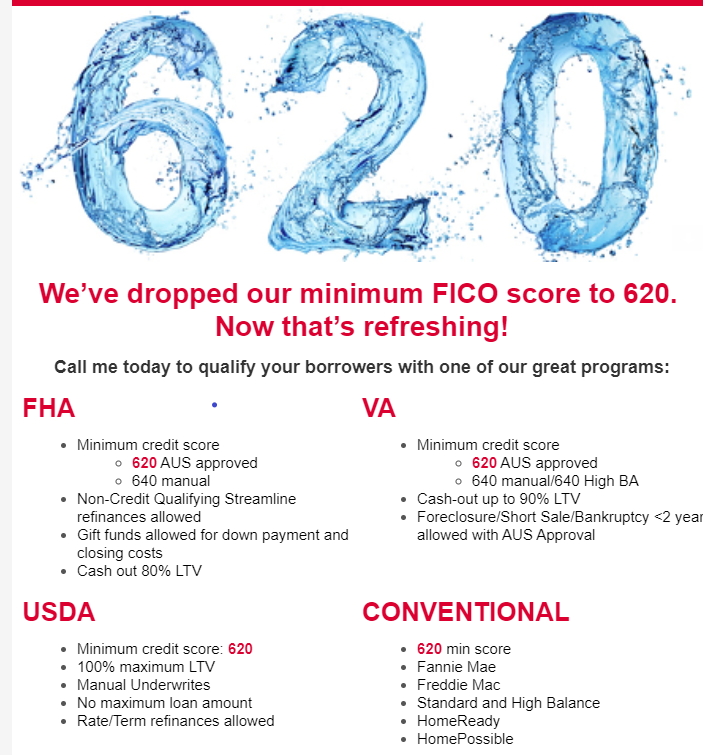

To get entitled to good USDA financing inside the Iowa, your month-to-month construction can cost you (financial dominant and you will attention, assets fees, and you can insurance rates) need fulfill a designated portion of the gross month-to-month money (29% ratio). Your own credit history would be very right here noticed. Good 620 FICO credit rating is necessary to get a beneficial USDA Outlying Construction Financing acceptance because of extremely lenders. You ought to also have adequate earnings to invest your own casing can cost you along with most of the more monthly financial obligation (41% ratio). This type of ratios would be exceeded some having compensating things. Applicants to own loans could have an income of up to 115% of one’s average money towards the city. Group should be in place of adequate casing, but be able to spend the money for home loan repayments, plus fees and you will insurance policies.

Outlying Innovation Mortgage loans when you look at the Iowa need no down-payment in addition they allow for the latest settlement costs becoming included in the loan count (assessment permitting).

Just what possessions designs are allowed to possess USDA Mortgages?

When you’re USDA Guidelines perform want that the possessions feel Owner Occupied (OO), nevertheless they will let you buy condos, planned device advancements, are created land, and you can solitary members of the family houses.

No responses yet