Long-term relationship

Money that need a good co-signer generally have amortization attacks of at least five otherwise 5 years. Mortgages might have amortizations as long as thirty years (whether or not 25 years is more popular during the Canada).

If you decide to help you co-signal for a loan otherwise mortgage, you are in it with the lasting. Sometimes it might be difficult to have your name fundamentally got rid of throughout the loan. However it can take place whether your number 1 borrower keeps increased the borrowing, enhanced the earnings, ple, by the increasing their house guarantee), otherwise a mixture of all of the over.

See that which you very first

It is a smart idea to ensure you get your own duplicate away from every financing otherwise home loan documentation your indication. And eg always, make sure you comprehend that which you before agreeing to help you indication people file. Getting the own copies may help manage both you and the latest primary debtor.

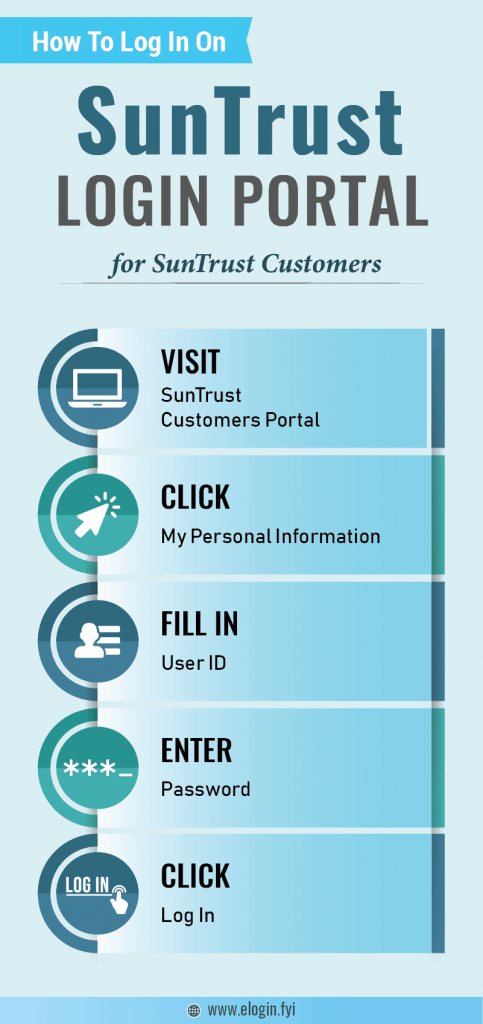

Gain access to account information

While responsible for the loan payment because a great co-signer, you should have full accessibility the loan information.

This way, you could potentially monitor one to repayments manufactured promptly. And you can keep track of people later repayments. A phone call note out-of an effective co-signer may convince the main borrower more good lender’s observe.

Consider insurance rates

What if one thing catastrophic was to eventually the key debtor? You, because the co-signer, would-be accountable for the loan money.

When you should state no in order to co-signing a home loan otherwise financing

If a friend otherwise cherished one asks you to definitely co-to remain a home loan software otherwise loan in their mind, there was of several emotions inside it. But you always need to make certain that your protect on your own first. Listed here are around three cases where saying no so you can co-signing is the best option.

You want to help you borrow money soon. Co-finalizing have a tendency to lower your borrowing from the bank as well as your capability to borrow for the the long term. When you have intends to pull out that loan of your own very own, co-signing could possibly get eradicate your ability to do this. And although you may not want to borrow funds quickly, points can transform easily.

You really have inquiries to the man or woman’s capacity to repay the loan. Remember, youre legally guilty of paying off people mortgage otherwise financial your co-signal for. For those who have hesitations to the someone’s capability to pay back, that’s probably not anyone we wish to co-indication for.

You do not have stellar borrowing from the bank. There is certainly a chance having less than stellar borrowing from the bank you may not meet the requirements once the a great co-signer. But when you perform simplycashadvance.net student college loans, financing you certainly will reduce your borrowing from the bank to the stage where you are now actually more of a threat so you’re able to lenders. And it will need days, or even decades, so you’re able to reconstruct your borrowing from the bank.

Reasons to co-signal a loan otherwise mortgage

There’s a conclusion that co-signers exists. And you may co-signing will be a great way to help anybody. Very, listed below are three times once you may think agreeing in order to co-signal for anyone.

You may have zero intentions to borrow temporarily. This also coincides with having good credit and you will a strong money. You dont want to put your future mind on the line by the co-signing that loan today.

The borrowed funds is for an almost loved one. Individuals could have an elevated sense of responsibility in the event that individual co-finalizing is actually a member of family. He’s a great deal more committed to the partnership and most likely don’t want to let you down of the defaulting to their repayments. A primary relative is additionally less likely to decrease and you can make you with cost of mortgage.

No responses yet